Introduction:

The shift from vertical to horizontal steering in organizations is a strategic development that is gaining momentum. Especially in sectors where innovation, customer orientation and speed are important, horizontal steering is increasingly seen as a key to success. Traditional organizational structures in which departments are functionally separated and goals are often internally focused are increasingly proving less effective in delivering added value and responding to environmental dynamics. This blog discusses the rise of horizontal steering and what this means for the finance function within organizations.

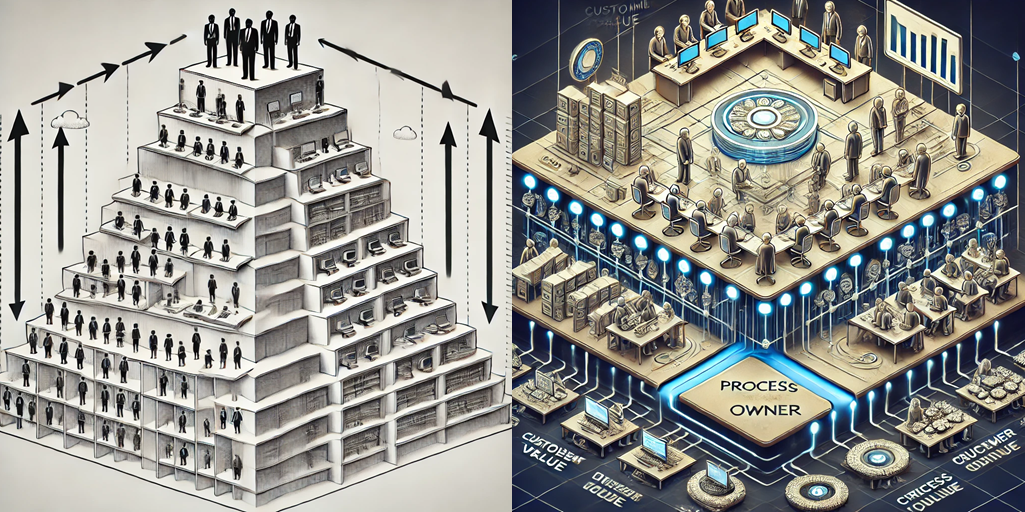

The limitations of traditional vertical organizations

In many companies, the traditional organizational form is still vertical, with not only the staff departments operating as separate silos, but also the primary process departments. This has significant disadvantages:

- Internal focus: The focus is often on internal processes rather than on the (customer) value delivered.

- Information loss: When information has to travel through multiple layers, crucial data slows down or is lost.

- Lack of collaboration: Different departments in different vertical columns have different goals, which hinders collaboration.

- Inertia in decision-making: Making decisions and responding to changes takes longer because of the layered hierarchy.

These constraints slow innovation and reduce customer focus. Private organizations struggle to remain competitive in a rapidly changing world. Public organizations cannot sufficiently live up to their right to exist.

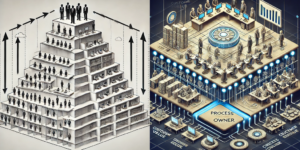

Why choose a horizontal organizational structure?

Horizontal steering focuses on processes rather than functions and hierarchies. This form of organization has gained considerable ground over the past 20 years due to agile thinking (and self-management), among other things. This provides a clear focus on customer value and process optimization. Benefits include:

- Customer focus: Organizing teams around core processes, such as product development, value chains or customer journeys, creates a culture in which all stakeholders contribute directly to customer value (or public value in the case of public sector organizations).

- Efficiency: Less transfer of work between departments. This reduces lead times and increases operational efficiency.

- Process control: In a horizontal structure, there are process owners who are responsible for the entire process, also called the chain. This leads to faster process improvements, more transparent processes and greater ownership.

- Agility: Horizontal structures allow quick adjustments without major restructuring, ideal in an ever-changing market.

The Role of Financials in Horizontal Transformation

For financials and controllers, the transition to horizontal structures represents both a new challenge and a new opportunity. Their role becomes broader than just monitoring finance. They will be involved in optimizing customer-oriented processes and strategic decision-making. Here it is crucial to look not only at traditional financial indicators, but also at performance indicators that measure process optimization, such as customer satisfaction or the speed (turnaround time) of customer journeys.

A finance function well embedded in horizontal structures can contribute to:

- Developing “other” performance indicators that go beyond financial figures and input control, for example, measurements of process output and customer satisfaction.

- Invest in technologies that support horizontal processes, such as workflow management systems that promote collaboration between teams.

- Improve understanding of customer and product returns by ensuring that the same horizontal structures are also the carriers of revenues and costs, providing integral insight into the returns of a customer journey or value chain.

Conclusion

The traditional vertical organization is increasingly ineffective in a rapidly changing environment. A horizontal process-oriented structure offers advantages in terms of customer focus, efficiency and agility.

For financials, controllers and CFOs, this means a shift in their role: they must become strategic partners in shaping this transformation. By working jointly with other departments on process optimization and the right KPIs, an organization can be created that is prepared for the challenges of the future.

The future is horizontal and financials have the opportunity to be at the helm of this important transformation.